Power generation, transmission, and distribution are integral processes in the power sector. Distribution Companies (DISCOMs) act as intermediaries, connecting power producers with households and serving as the interface between utilities and consumers. In India, DISCOMs are primarily owned by state governments, although a few private DISCOMs operate in select cities.

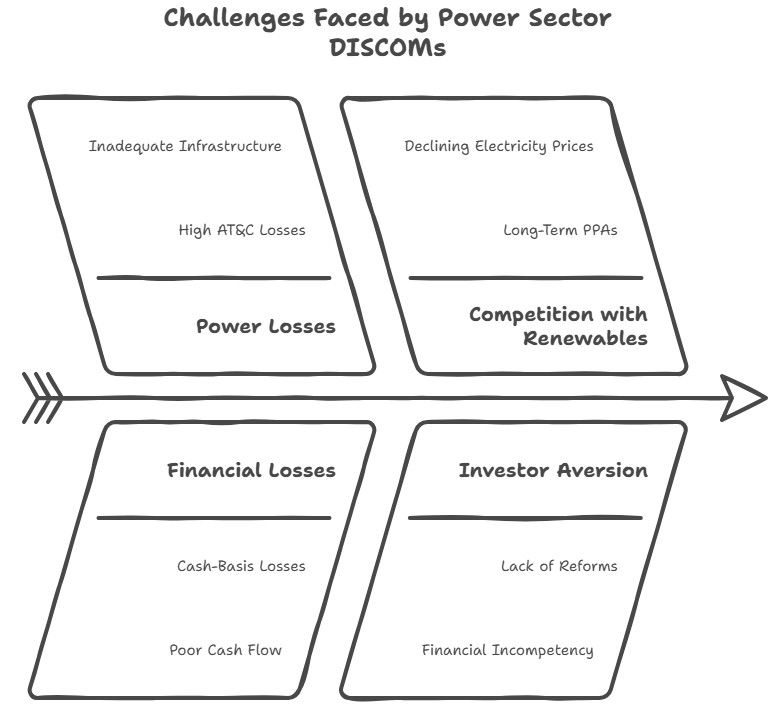

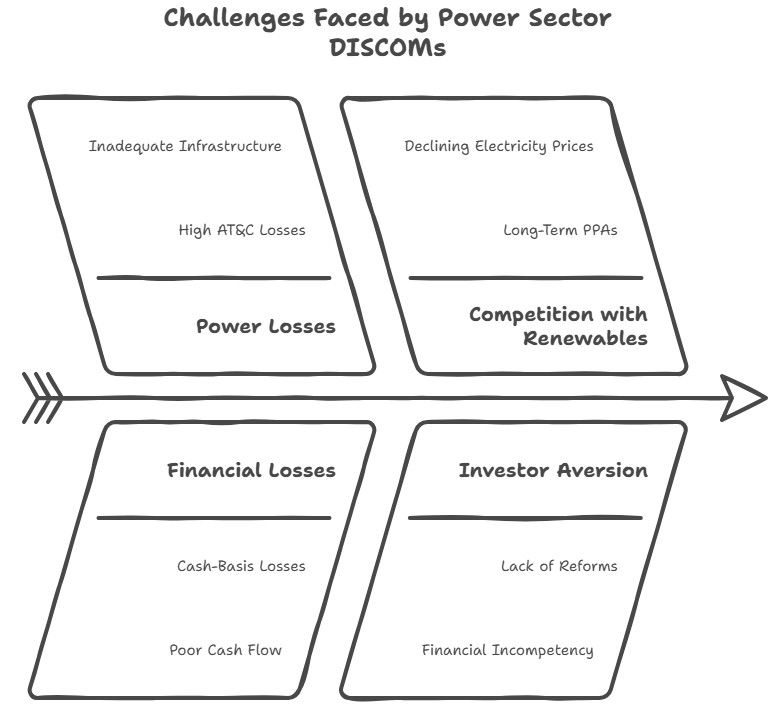

Challenges Faced by Power Sector DISCOMs

- Power losses: High technical and commercial aggregate (AT&C) losses of 17% (FY 2022) due to inadequate infrastructure, theft, and unpaid bills. AT&C losses encompass energy losses during transmission and distribution, theft, billing inefficiencies, collection inefficiencies, and payment delays.

- Financial losses: Over 15 years through FY2021, public discoms were found to have suffered a cash-basis loss of ?10 lakh crore.

- Poor cash flow: Delayed consumer payments result in insufficient cash income, preventing timely payments to energy generators. This leads to operational liabilities with power and transmission companies.

- Missing measurements: Inadequate measurement at different levels of the distribution chain makes it difficult to identify areas of loss and take corrective action.

- Competition with renewable energy: Long-term power purchase agreements (PPAs) and the declining price of electricity, particularly from coal-based power generation, have created financial rigidity for DISCOMs, resulting in losses.

- Rise of informal credit: DISCOMs have increasingly delayed payments to producers and other stakeholders.

- Ambitious projects without sufficient support: Expansion plans to provide electricity to all citizens require a review of the cost structure and an expansion of the distribution network.

- Profitability: The gap between the average cost of supply and the average realized revenue for DISCOMs is currently estimated at Rs. 0.49 per unit, resulting in accumulated losses and delayed payments to generators.

- Foreign investor averse to invest despite 100% FDI – due to lack of visible reforms, financial incompetency, long gestation period, huge delays in commissioning, etc.

Private Sector Participation in Power Sector DISCOMs

- Operational autonomy - This can lead to rationalisation of fares and revival of fiscal health of DISCOMS.

- Efficiency and profit motive - Profit driven approach also creates a more efficient value chain. Private sector usually carry acumen in reducing losses and building sustainability through profits.

- Innovation mechanism like smart metering can be brought by the private sector.

- Better Customer Service - increased revenue, reduced inefficiencies, and introduction of better technologies and more competition will help provide a better overall consumer experience.

- For eg. Smart prepaid meters will allow transparency for consumers, help DISCOMs reduce AT&C losses, and ensure billing accuracy which leaves no scope for human errors.

- Nuanced planning - The private sector’s ability to strategize for the long-term is essential in an area like power distribution.

- Opportunity to start afresh – The standard bidding document puts forth that the winning entity will be provided with a clean balance sheet, free of accumulated losses and all unserviceable liabilities.

- Diversified options for attracting investment - Private participation in power distribution can follow various models: licensing, distribution franchisee, etc. Various PPP models will be tested and will assist in generating private sector appetite amongst Indian and international investors.

- Technological advancements - deployment of advanced metering infrastructure, smart grids, and distribution automation systems for better monitoring of electricity consumption, reduced losses, and improved billing accuracy.

- Successful example – Delhi privatised DISCOMs in 2002 and witnessed a complete turnaround ???? AT&C losses have come down from 55% in 2002 to about 9% in 2022.

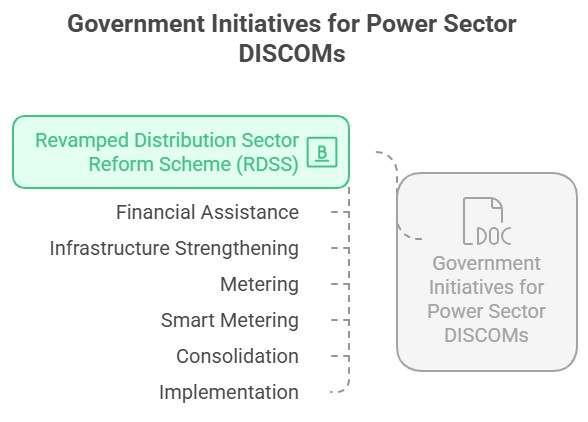

Government Initiatives for Power Sector DISCOMs

- Revamped Distribution Sector Reform Scheme (RDSS): Launched in July 2021, this central government grant-based program aims to improve the operational efficiencies and financial sustainability of DISCOMs (excluding private sector DISCOMs).

- It provides conditional financial assistance to strengthen the supply infrastructure of DISCOMs.

- The program allocates half of its budget to better feeder and transformer metering and prepaid smart consumer metering.

- RDSS consolidates existing power sector reform schemes, including the Integrated Power Development Scheme, DDU Gram Jyoti Yojana, and Pradhan Mantri Sahaj Bijli Har Ghar Yojana.

- The Rural Electrification Corporation and Power Finance Corporation are responsible for implementing this program.

Issues Associated with RDSS

- RDSS inherited design issues from previous schemes, including complex processes and conditions for fund disbursal. Only 60% of the allocated grants in past schemes were disbursed.

- UDAY Scheme: Launched in November 2015, the Ujjwal DISCOM Assurance Yojana (UDAY) was designed to turn around the financial position of DISCOMs.

- The state governments took over 75 % of the debt of their DISCOMs, issuing lower-interest bonds to service the rest of the debt.

- In return, DISCOMs were given target dates (2017-19) to meet efficiency parameters like reduction in power lost through transmission, theft and faulty metering.

- Reforms-Linked, Result-Based Scheme for Distribution (RLRBSD): In budget 2021-22, the Union government had announced the launch of a “reforms-based and results-linked” scheme for improving the financial health and operational efficiency of discoms.

- Under the scheme, AT&C losses will be brought down to 12-15% by 2025-26, from 21-22%.

- Operational efficiencies of discoms will be improved through smart metering and upgradation of the distribution infrastructure, including the segregation of agriculture feeders and strengthening the system.

- Liquidity Scheme: To help these DISCOMs, the Centre in May 2020, announced a Liquidity Infusion Scheme (Aatmanirbhar Bharat Abhiyan), under which loans of ?1,35,497 crore have been sanctioned.

Way Forward

- Strengthening Rural Networks: Investing in rural network infrastructure is crucial to meet the growing demand for electricity, especially in rural areas.

- Fulfilling Agricultural Consumer Requirements: The PM-KUSUM scheme aims to provide day-time, low-cost power supply to farmers by installing large-scale solar plants.

- Automatic metering of distribution feeders: Equipping all feeders with meters capable of communicating readings without manual intervention can enhance accuracy in loss estimation

- Role of states: States should identify implementation issues, devise suitable metering strategies, and create frameworks to assess the benefits and costs of prepaid and postpaid metering.

Conclusion

By addressing the challenges faced by DISCOMs requires a multi-pronged approach involving strengthening rural networks, fulfilling agricultural consumer requirements, implementing automatic metering, and active participation of states in strategizing and evaluating initiatives. With these efforts, the power sector can move towards financial sustainability and provide reliable electricity supply to all consumers.