Discover the significance of MSMEs in India’s economy, their revised classification, key challenges, government schemes, and growth potential. Learn how MSMEs drive GDP, exports, and employment while supporting Make in India & Atmanirbhar Bharat.

The Micro, Small and Medium Enterprises (MSMEs) sector plays a vital role in the Indian economy. The sector contributes almost 8% of the country's GDP, around 45% of manufacturing production, and about 40% of exports.

MSMEs currently employ over 46.6 million people, as per the national sample survey (2019).

Despite its significance, the sector faces numerous challenges, including low registration on the UDYAM Platform, heterogeneity, fragmentation, and informalization. To unlock the full potential of MSMEs and propel the Indian economy towards higher growth, targeted policies in infrastructure development, technology adoption, and backward and forward linkages are necessary.

Revised MSME Classification

|

|

Composite Criteria: Investment & Annual Turnover

|

|

Classification

|

Micro

|

Small

|

Medium

|

|

Manufacturing & Services

|

Investment < Rs. 1 crore

Turnover < Rs. 5 crore

|

Investment < Rs. 10 crore

Turnover < Rs. 50 crore

|

Investment < Rs. 50 crore

Turnover < Rs. 250 crore

|

MSME Status & Significance in MSME Sector in India

- Economic Significance

- Composition - > 99% of MSMEs are in ‘Micro’ sector, 94% of MSME are unregistered with the government, 55% of MSME in rural areas.

- Diversity of MSME sector - products ranging from traditional to high –tech precision items.

- Comprises key sunrise sectors – such as electronics industry, chemicals, leather, textiles, agro and food processing, pharmaceuticals, transport and tourism industries, etc

- High Labour Intensity - Provides employment to 80% population with just 20% investment. Generates 2nd highest employment, after Agriculture sector. Thus, key to poverty alleviation and to prevent distress migration.

- Growth Potential: There are over 36.1 million MSME units in India, with the Ministry aiming to increase its GDP contribution to 50% by 2025 as India's economy grows to $5 trillion.

- Key to Inclusive growth - Creating employment opportunities for special segments such as women, physically challenged, traditional industries, etc.

- Strategic significance - MSME is a key component in ‘Make in India’, Digital India, Start-up India, Stand up India, Indigenous Defence production, Foreign Trade Policy, & e- commerce initiatives of GoI.

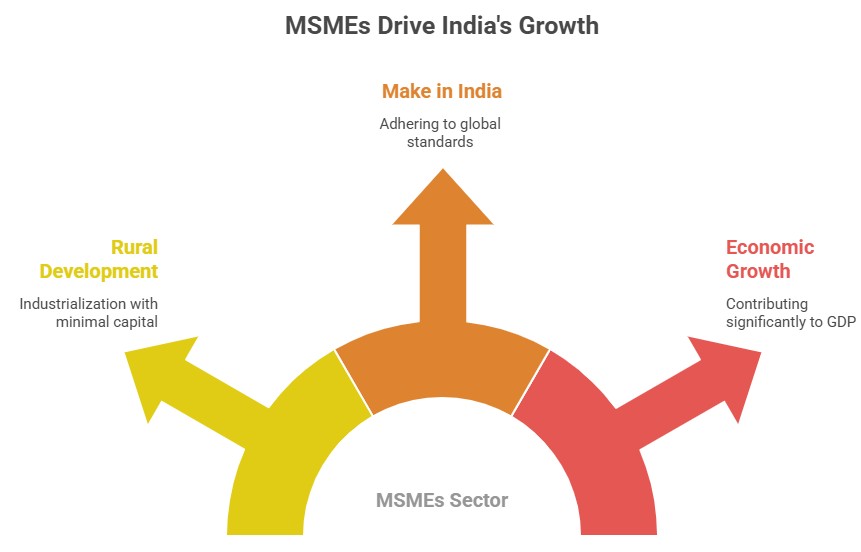

Significance of MSME Sector in India

- Boon for Rural Development: MSMEs have contributed to the industrialization of rural areas with minimal capital cost, leading to socio-economic growth and complementing major industries.

- Front Runner in Make in India Mission: MSMEs are crucial in making the 'Make in India' initiative successful by adhering to global quality standards and becoming the backbone of the mission.

- Simple Management Structure for Enterprises: Compared to large corporations, MSMEs offer a flexible management structure that allows for easy decision-making and efficiency.

- Economic Growth and Leverage Exports: MSMEs significantly contribute to India's GDP, accounting for 8% of it. Moreover, they have the potential to create linkages between India's MSME base and larger companies by supplying semi-finished and auxiliary products.

Factors Leading to the Growth of MSME Sector in India

- Promoting Innovation and Competitiveness: MSMEs provide opportunities for aspiring entrepreneurs to develop innovative products, fostering competitiveness and driving growth.

- Government Campaigns: Initiatives like Make in India, Startup India, Skill India, and Digital India aim to level the playing field and promote increased production.

- Adapting to Labor Market Trends: Younger generations are moving away from agriculture and entering businesses, creating employment opportunities.

- New Definition: The new definition and classification eliminate the need for frequent inspections and provide transparency and impartiality.

- Digitization: Growing internet use and digital payment comfort, supported by B2C e-commerce firms, facilitate MSME sector expansion.

- Collateral-Free Financing: Partnerships with modern non-banking finance enterprises offer MSMEs easier access to financing.

Various Government Initiatives for MSME Sector in India

- Udyami Mitra Portal: Launched by SIDBI to improve credit accessibility and provide handholding services to MSMEs.

- MSME Sambandh and MSME Samadhaan: Monitor and address delayed payments by central ministries/departments/CPSEs/state governments.

- Digital MSME Scheme: Enables MSMEs to access common and tailor-made IT infrastructure through cloud computing.

- Revamped Scheme of Fund for Regeneration Of Traditional Industries (SFURTI): Organizes traditional industries and artisans into clusters to enhance competitiveness.

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE): Creates new job opportunities and promotes an entrepreneurship culture.

- Micro & Small Enterprises Cluster Development Programme (MSE-CDP): Implements a cluster development approach to increase productivity and competitiveness.

- Credit Linked Capital Subsidy Scheme (CLCSS): Upgrades technological expertise of MSMEs.

Current Challenges in MSME Sector in India

- Financial Constraint: Access to timely finance remains an issue, with only 16% of SMEs having such access, leading to heavy reliance on their own resources.

- Lack of Innovation: MSMEs struggle with outdated technologies and low productivity due to a lack of entrepreneurial spirit and innovation.

- Majority of Small Firms: Micro and small businesses constitute over 80% of MSMEs, but they often struggle to take advantage of government initiatives.

- Communication gaps and lack of awareness hinder their access to emergency credit lines, stressed asset relief, equity participation, and fund of funds operations.

- Lack of Formalization Amongst MSMEs: A significant number of MSMEs in India operate without formal registration, leading to credit gaps and limited access to support.

- Approximately 86% of manufacturing MSMEs remain unregistered, hindering their ability to avail themselves of benefits and services.

- The Goods and Services Tax registration rate for MSMEs is relatively low, with only about 1.1 crore entities registered.

- Mounting NPAs in MSMEs: The MSME sector has witnessed a rise in non-performing assets (NPAs) during recent times.

- As per the Reserve Bank of India (RBI), bad loans of MSMEs account for 9.6% of gross advances, up from 8.2% in 2020.

- Many MSMEs did not benefit from restructuring schemes and relief packages, aggravating their financial distress.

- Lack of Infrastructure and Technology: Inadequate infrastructure and outdated technology pose significant challenges for MSMEs in India.

- Power supply issues, including poor quality and unscheduled cuts, impede smooth operations.

- Insufficient substations, inadequate road networks, Lack of proper transport facilities, ineffective storm water drainage, and limited sewage treatment plants further hamper growth.

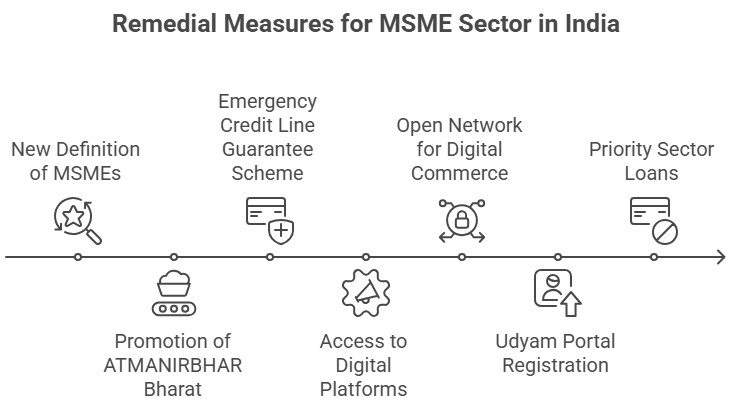

Remedial Measures for MSME Sector in India

- New Definition of MSMEs: The Indian government has provided a new definition for MSMEs.

- Promotion of ATMANIRBHAR Bharat and Make in India: The government has prohibited global procurement contracts of up to INR 200 crores and promoted ATMANIRBHAR Bharat.

- Emergency Credit Line Guarantee Scheme: Providing loans with a 100% guarantee to eligible MSME borrowers to address capital shortages.

- Access to Digital Platforms: Private sector and government support provide MSMEs with access to digital platforms for marketing and payments.

- E-commerce websites have also encouraged the onboarding of MSMEs.

- Open Network for Digital Commerce creating opportunities for MSMEs to access technology and diversify their target markets.

- Sign of Robust Recovery: Greater formalization and growth in GST collections indicate a positive recovery. More than 10 million MSME units have registered on the Udyam portal since July 2020.

- Udyam Portal: The online registration portal has facilitated the registration of over 10 million MSME units since its launch.

- MSME registration process is fully online, totally free, paperless and based on self-declaration and is a step towards Ease of Doing Business for MSMEs.

- No documents or proof are required to be uploaded for registering an MSME. With Udyam number banks can categorize lendings to MSMEs as priority sector loans.

Way Forward

- Regulatory Mechanism

- Establishment of an independent body to safeguard MSMEs from economic shocks and promote their growth.

- Supply Chain Finance

- Provide MSMEs with access to working capital through technology-enabled platforms and encourage Zero Defect & Zero Effect practices.

- Enables MSMEs to invest in expansion, procure raw materials, and update inventories.

- Linking Government Projects with Local MSMEs

- Foster domestic manufacturing capabilities by leveraging public procurements and projects.

- Close linkage between initiatives like Sagarmala, Bharatmala, and industrial corridors with the MSME sector.

- Promotes collaboration between the government and MSMEs for enhanced growth and employment opportunities.

- Industry-Academia Channel

- Strengthen collaboration between government, industry, and academia to identify manufacturing requirements and develop a skilled workforce aligned with Industrial Revolution 4.0.

- Bridge the gap between education and industry needs, fostering innovation and driving technological advancement.

- Dedicated MSME Portal

- Creation of a dedicated portal for MSME formalization and registration to enhance transparency and reduce fraudulent activities.

- Use of Aadhaar or PAN as a unique identifier for compliance purposes and simplification of the annual registration process.

- E-Courts for Dispute Resolution

- Strengthen the NCLT framework by introducing alternative methods of debt resolution, including e-courts.

- Faster resolution of cases to reduce financial burdens on MSMEs and enhance their overall competitiveness.

- Incentivizing Digital Adoption Within the Sector

- Provide incentives for digital adoption, especially in disruptive technologies like artificial intelligence and quantum technology.

- Encourage innovation, efficiency, and competitiveness within the MSME sector.

Conclusion

MSMEs are the backbone of the Indian economy, providing resilience against global economic shocks. To revive the economy and address the challenges faced by MSMEs, a comprehensive approach is required, including easing regulatory burdens, fiscal support, and ensuring a level playing field. By prioritizing the interests of MSMEs, India can unlock their full potential and foster inclusive growth.