The Ministry of Finance launched a saturation campaign (July–Sept 2025) to boost financial inclusion and extend PMJDY, PMJJBY, PMSBY & APY benefits to all Gram Panchayats and Urban Local Bodies, ensuring last-mile access to key financial services.

Context

- The Department of Financial Services (DFS), Ministry of Finance, launched a three-month nationwide saturation campaign, effective from 1st July 2025 to 30th September 2025 to bolster the outreach of flagship schemes such as Pradhan Mantri Jan Dhan Yojana (PMJDY).

- It also included Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), and Atal Pension Yojana (APY)..

Aim

- This campaign seeks to achieve comprehensive coverage across all Gram Panchayats (GPs) and Urban Local Bodies (ULBs), ensuring that every eligible citizen is able to avail the intended benefits of these transformative schemes.

About Financial Inclusion: What is it?

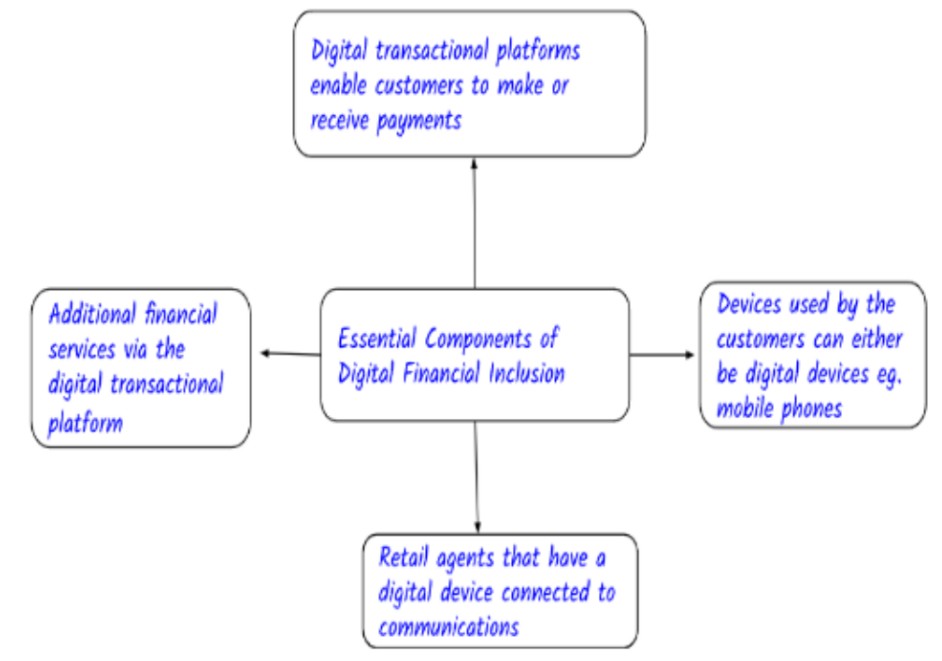

- Financial inclusion refers to ensuring that individuals and businesses can access essential financial products and services, such as savings accounts, loans, insurance, and payment services, at affordable prices.

- Financial inclusion aims to eliminate the barriers that prevent people from participating in the financial sector and using its services to improve their lives. It is also known as inclusive finance.

- Financial inclusion can refer to geographical regions, consumers of a particular gender, consumers of a certain age, or other marginalised groups. Financial inclusion may result in increased overall innovation, economic growth, and consumer knowledge.

Objective

- Financial inclusion aims to offer essential financial services, including basic no-frills accounts for payments, savings and pension products, simple credit and overdrafts, money transfer options, micro-insurance, and micro-pension solutions.

- Financial inclusion ensures accessible, affordable financial services for all, regardless of income or location.

- It promotes economic stability by enabling universal access to banking, credit, and insurance, empowering individuals to participate in the formal financial system.

Status of Financial Inclusion In India

India has made significant strides in promoting financial inclusion, but gaps remain. In consultation with the concerned stakeholders, including the government, the Reserve Bank of India constructed FI-Index to capture the extent of financial inclusion across the country.

- Overall Banking: According to the World Bank Global Findex Database (2021), about 78% of Indian adults have bank accounts.

- However, account usage and access to credit continue to be low.

- Digital Payment: UPI has transformed digital payments nationwide; at a compound annual growth rate (CAGR) of 129%, UPI transaction volume increased from 92 crore in FY 2017–18 to 13,116 crore in FY 2023–24.

- Gender Disparity: According to the National Statistical Office‘s “Women and Men in India 2023” report, women account holders account for only 20.8%, or roughly one-fifth, of total bank deposits in India.

- Presence of Informal Banking: Despite progress, disparities in financial inclusion persist, with rural and low-income groups having limited access. Many still depend on informal, often costly financial services like moneylenders and savings groups.

Initiatives for Financial Inclusion In India

The Government of India has implemented various financial inclusion initiatives to enhance access to banking and financial services, such as PMJDY, PM Mudra Yojana, UPI, and Kisan Credit Card, ensuring financial empowerment for all citizens.

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in 2014, PMJDY is the world’s largest financial inclusion initiative, aiming to provide bank accounts to every household in India.

- The scheme offers zero-balance accounts, accident insurance up to Rs 1 lakh, and overdraft facilities of up to Rs 10,000, providing financial security and emergency support to eligible holders.

- Under PMJDY, over 53 crore bank accounts have been opened by August 2024, ensuring basic savings, overdraft facilities, and accidental insurance.

- This ambitious program forms a crucial pillar of the JAM trinity (Jan Dhan-Aadhaar-Mobile), which serves as a powerful tool for direct benefit transfers and financial inclusion.

- Pradhan Mantri Mudra Yojana: This scheme provides loans to micro and small enterprises to help them start or expand their businesses. Since its inception, as of April 2023, MUDRA has disbursed over ₹23 lakh crore to MSMEs, fueling entrepreneurship and employment in low-income communities.

- Unified Payments Interface (UPI): UPI revolutionised digital transactions in India by providing a real-time payment system through smartphones.

- By 2023, UPI processed over 14 billion transactions per month.

- Banking Correspondents Model: It promotes financial inclusion by deploying representatives to offer banking services in remote, unbanked areas. These agents handle deposits, withdrawals, microfinance loans, and essential banking functions.

- Kisan Credit Card: The Kisan Credit Card (KCC) scheme is a financial inclusion initiative launched by the Government of India in 1998 to provide easy and hassle-free credit to farmers to meet their short-term and medium-term credit needs.

- The scheme allows farmers to access credit from banks and financial institutions through a simple and convenient process, eliminating the need for collateral or other guarantees.

Challenges for Financial Inclusion

- Demand Side Factors: Lower income or asset holdings, lack of awareness about the financial products, high transaction costs, etc.

- Supply side challenges: Financial institutions' refusal to serve low-value and non-profitable consumers with uneven income.

- Digital and Infrastructure Gaps: The digital divide, inadequate mobile connectivity, and frequent power failures particularly in remote areas.

- Regulatory challenges, such as stringent Know-Your-Customer (KYC) requirements, make it difficult for low-income individuals to access financial services.

- Lack of Financial Literacy: Many potential users lack the basic financial literacy needed to effectively use formal financial services, which can lead to the exclusion of vulnerable groups.

- For instance, due to poor financial literacy, around 20% of the PMJDY Accounts are dormant and approximately 8.4% of the accounts currently have a zero balance.

Significance of Financial Inclusion

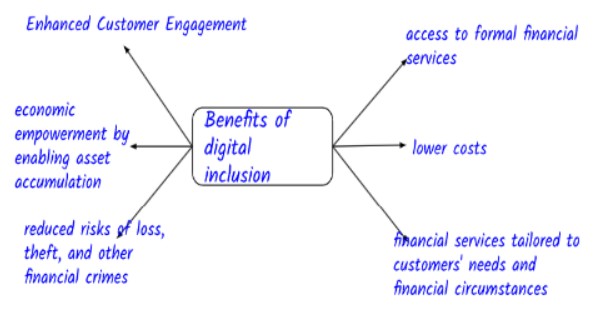

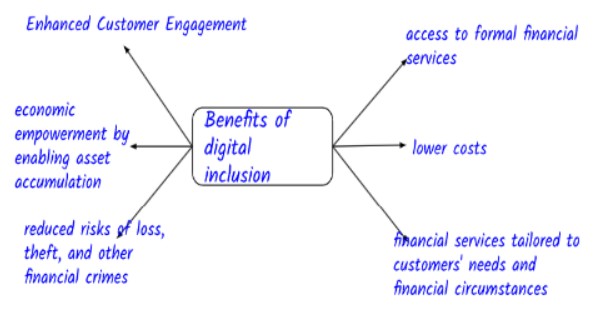

- Plugging the Credit gap: Access to formal and adequate credit from the formal banking channels can fuel the enterprising spirit of the masses in order to create economic output and enhance income levels at the grassroots.

- It allows MSMEs to access credit, which can enhance their capacity to grow, generate jobs, and contribute to national GDP.

- Encouragement of Saving Habits: With access to banking services, people are encouraged to save money regularly.

- This can help increase capital formation in the country and provide an economic boost.

- Inclusive growth: Financial inclusion is critical for poverty reduction as this helps in transferring the benefits of economic growth and development to the lowest strata of the population.

- It creates a multiplier effect by encouraging investment in education and health, driving long-term economic development.

- Plug the subsidy gaps: The Government's push for Direct cash transfers to the recipient's bank accounts instead of providing subsidies inefficiently.

Way Forward

- Foster Public-Private Partnerships: Collaborations between governments, financial institutions, and telecom companies can accelerate financial inclusion.

- Public policies should encourage private sector involvement in providing mobile money services and digital payment platforms.

- Promote Financial Literacy: RBI, in coordination with other banks and educational institutions, scan ensure financial inclusion as a subject from school to higher levels of education.

- Leverage Fintech Innovations: Fintech solutions like mobile banking, digital payments, and alternative credit scoring models can cater to unbanked populations by providing low-cost, scalable financial services.

- Tailored Financial Products: Financial institutions can offer customized products suited to the needs of low-income groups, such as microinsurance and pension schemes. E.g. PM Atal Pension Yojana.