The GN Bajpai committee recently recommended that the Insolvency and Bankruptcy Board of India (IBBI) create a standardised framework for the five-year-old IBC (IBC). This framework needs a real-time data bank with time, cost, recovery rates, and macroeconomic indicators. To evaluate and improve law implementation.

Objectives of the Insolvency and Bankruptcy Code (IBC)

The committee emphasizes that resolving distressed assets remains the primary objective of the IBC. It is followed by promoting entrepreneurship, ensuring credit availability, and balancing the interests of stakeholders.

Understanding Insolvency and Bankruptcy Code, 2016

- Introduced in 2015 and implemented in 2016, the Code aims to provide a unified framework for resolving insolvency and bankruptcy cases in India.

- Insolvency refers to the inability of individuals or organizations to fulfil their financial obligations.

Insolvency Resolution Process under the Insolvency and Bankruptcy Code (IBC)

- For individuals, the insolvency resolution process differs from that of companies. Either the debtor or the creditors can initiate these processes.

- Resolution process for companies and limited liability partnerships:

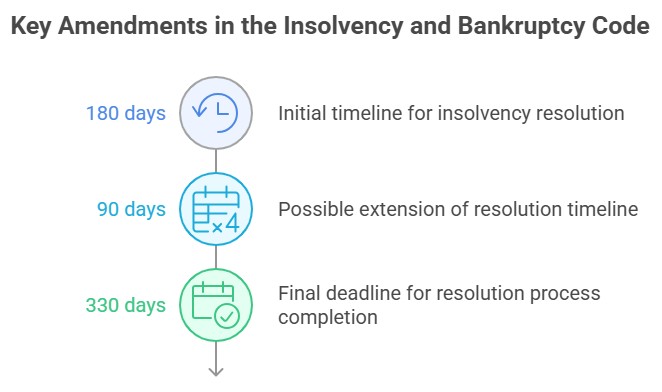

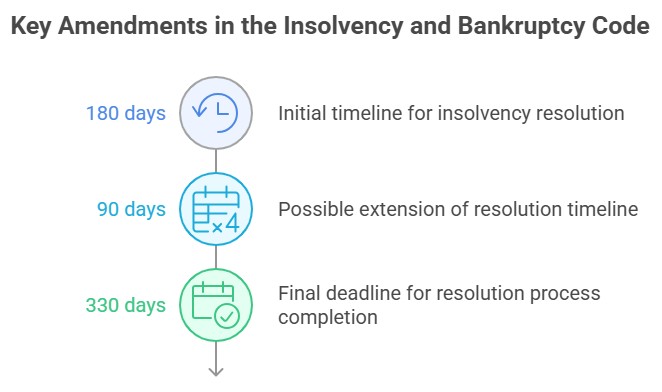

- Must be completed within a maximum of 180 days from case registration, with a possible 90-day extension upon agreement by 75% of financial creditors.

- Involves negotiations between debtors and creditors to draft a resolution plan.

- Concludes when a resolution plan is agreed upon by the majority of creditors and submitted to the adjudicating authority or when the negotiation period expires

- Resolution process for individuals and partnerships:

- Debtors may apply for debt forgiveness if their assets fall below a limit set by the central government. This process must be completed within six months.

- Insolvency resolution negotiations between debtors and creditors are supervised by insolvency professionals.

- If negotiations succeed, a repayment plan approved by the majority of creditors is submitted to the adjudicator. Failure leads to bankruptcy resolution.

Need for the Insolvency and Bankruptcy Code (IBC) in India

- Delay in insolvency resolution: As of 2015, Indian insolvency resolution averaged 4.3 years. This is much higher than the UK (1 year) and US (1.5 years).

- Scattered laws relating to insolvency and bankruptcy: Before IBC, India had many insolvency and bankruptcy laws. The resolution process was delayed and ineffective. SARFAESI, RDDBFI, and Companies Acts are examples.

Recent Amendments in the Insolvency and Bankruptcy Code (IBC)

- Representative of financial creditors: During the insolvency resolution process, a Committee of Creditors (CoC) is formed to make decisions through voting. Representatives of financial creditors participate and vote on their behalf.

- Undischarged insolvents, willful defaulters, convicted criminals, and Companies Act-disqualified directors are ineligible. Prohibited selling defaulter's property to such individuals during liquidation.

- Lower voting threshold for routine decisions: The voting threshold for routine decisions by the CoC was reduced from 75% to 51%.

- Recognition of homebuyers as financial creditors: Homebuyers who have paid advances to a developer are now considered as financial creditors.

- Withdrawal of resolution application: With 90% CoC approval, the amendment lets the NCLT withdraw a resolution application.

- Applicability of the Code to MSMEs: Micro, Small, and Medium Enterprise resolution applicants are exempt from NPA and guarantor ineligibility criteria (MSMEs).

- Time-limit for resolution process: The Code requires insolvency resolution to be completed within 180 days, extendable by 90 days.

- This Amendment adds that the resolution process must be completed within 330 days. This includes time for any extension granted and the time taken in legal proceedings in relation to the process.

- Additional threshold for initiating resolution process: Added a threshold for certain financial creditors, including real estate project allottees. At least 10% or 100 must start the process together.

- Continuation of critical goods and services supply: Empowered resolution professionals to require suppliers to continue providing essential goods and services during the insolvency resolution process.

- Suppliers must receive payment for their current dues to continue supplying.

- Liability protection for new owners: If management or control changes, a company in insolvency resolution is not liable for prior offences.

Proposed Amendments in 2022

- Appointing Common Resolution Professional

- Redesigning Fast-Track Corporate Insolvency Resolution Process (FIRP)

- Special framework for resolution of real estate to limit IBC proceedings to insolvent projects.

- Electronic platform.

- Empowering IPs to transfer ownership of property.

- Extension of pre-packaged insolvency resolution framework to larger entities.

- Multiple resolution plans for single stressed firm.

How the Insolvency and Bankruptcy Code (IBC) Benefits Stakeholders

- For debtor: It promotes entrepreneurship, as IBC framework facilitates easy exit for loss making companies.

- Maximization of the value of assets of corporate persons.

- It helps in reviving the company in a time-bound manner.

- For creditors: It protects the interest of creditors, and consequently increases the credit supply in the economy

- Timely recovery procedure helps banks/financial institutions to reduce their NPAs

- For Government: Helps in reducing number of time-consuming litigations

- Simplifying procedure: It consolidates and amends all existing insolvency laws in India, hence simplify and speed-up the Insolvency and Bankruptcy proceedings.

Successes of the Insolvency and Bankruptcy Code (IBC)

- High recovery rate: Before enactment of the IBC, the recovery mechanisms available to lenders were through Lok Adalat, Debt Recovery Tribunal and SARFAESI Act.

- According to a World Bank statement, IBC has improved the recovery rate of stressed assets to 48% in two years from 26% in the pre-IBC era

- Higher credit realization: Till June 2020, 250 companies had been rescued and 955 others referred for liquidation. According to IBBI, the resolution plans yielded about 191% of the realizable value for financial creditors

- Improvement in ease of doing business ranking: IBC played an indisputable role in improving India’s Ease of Doing Business (EODB) ranking from 130 in 2016 to 63 in 2020.

Issues

- Poor compliance to timelines: Despite the extension, resolution plans continue to cross the deadline. On average, it takes 380 days for resolution plans to reach a conclusion.

- Institutional issues

- Limitation of DRTs/NCLT – Inadequate manpower (50% posts in NCLT lying vacant), sluggish disposal of cases, huge pending cases, inadequate infrastructural facilities etc.

- Poor & insufficient infrastructure of the Information Utilities (IU) that provides access to credible and transparent evidence of default.

- Inadequate number of Insolvency Professionals (IPs) to manage the rising number of cases.

- Underdeveloped Secondary asset market – To find buyers for stressed assets.

- Complex nature: IBC process also involves a number of stakeholders with competing interests, which further makes resolution complex and time-consuming.

- Issue in order of priority to distribute assets during liquidation: Unsecured creditors have priority over trade creditors, and government dues will be repaid after unsecured creditors.

- Fragmented information in multiple IUs: Code provides for the creation of multiple IUs. However, it does not specify that full information about a company will be accessible through a single query from any IU.

- Performance bond: The Joint Committee of Parliament, which examined the Code, noted that requiring a performance bond may deter IPs and IPAs from entering the sector.

- Conflict of interest in IPAs: Code allows for multiple IPAs to operate simultaneously, which could enable competition in the sector.

- Accountability of Committee of creditors (CoC) – Even though the CoCs have significant discretion in the resolution process, there is no mechanism to ensure accountability and transparency of its decisions.

- Burden for small creditors: All operational creditors must submit financial information to IUs, which may be difficult for small creditors to do.

Way Forward

- Adopting recommendations of the GN Bajpai committee: Setting up specialized National Company Law Tribunal benches to hear only IBC matters

- Digitalizing IBC platforms in order to make the resolution process faster and maximise the realisable value of assets.

- Enhance institutional capacity of the NCLT benches: There is a need to increase the number of appointments of judicial members/experts.

- Overcoming pendency: Provide funds and functionaries to DRTs and NCLT for timely disposal of cases.

- Leveraging greater expertise by appointing judicial members of NCLT at least at the level of High Court judges & Specialised NCLT benches to hear only IBC matters.

- Background checks in terms of conflict and integrity should be done for insolvency professionals, with timelines being set to complete proceedings

- Encouraging pre-packaged insolvency - to streamline resolution process and reducing burden on NCLT.

- Capacity Building - Training of the lawyers, IPs, IPAs, and IUs to implement the law in its letter & spirit.

- Robust technological infra & data collection – End-to-end digitization of processes & improved data gathering by IUs to make the resolution process faster, and maximise the realisable value of assets.

- Draft Framework for Cross Border Insolvency, recently published by Min. of Corporate Affairs, based on UN Commission on International Trade Law (UNCITRAL) Model Law, to be expeditiously finalised.

- Other reforms – Continuous review of IBC, holistic banking sector reforms etc.

GN Bajpai Committee: Key Recommendations on Insolvency and Bankruptcy Code

Establishing the ‘Priority order’ of IBC Objectives – (1) Resolution of the distressed asset, (2) Promotion of entrepreneurship, (3) Availability of credit, (4) Balancing the interests of stakeholders.

- Designing a standardised framework to track the outcomes of insolvency and bankruptcy regime.

- Capturing reliable real-time data which is essential to assess the performance of the insolvency process.

- Tracking both quantifiable and nonquantifiable outcomes of the Code.

- Survey to calculate exact cost of Insolvency process - on the lines of the World Bank’s ease of doing business.

|